Developers built the city up despite rising interest rates, empty offices and a major multifamily policy loss.

JUL 3, 2023, 7:00 AM

By Ellie Quilan Houghtaling

Research by Matthew Elo

Uncertainty reigns in real estate, but New York City developers are still reaching for the sky.

The city’s biggest builders have spent the past year shackled by rising interest rates, persistent supply-chain issues, a battered office market and a murky future for multifamily projects without the popular 421a tax break.

Despite all of this, developers came out of the year predicting gains in a down market and a cheery outlook for the city’s resilience as it continues to recover from the pandemic.

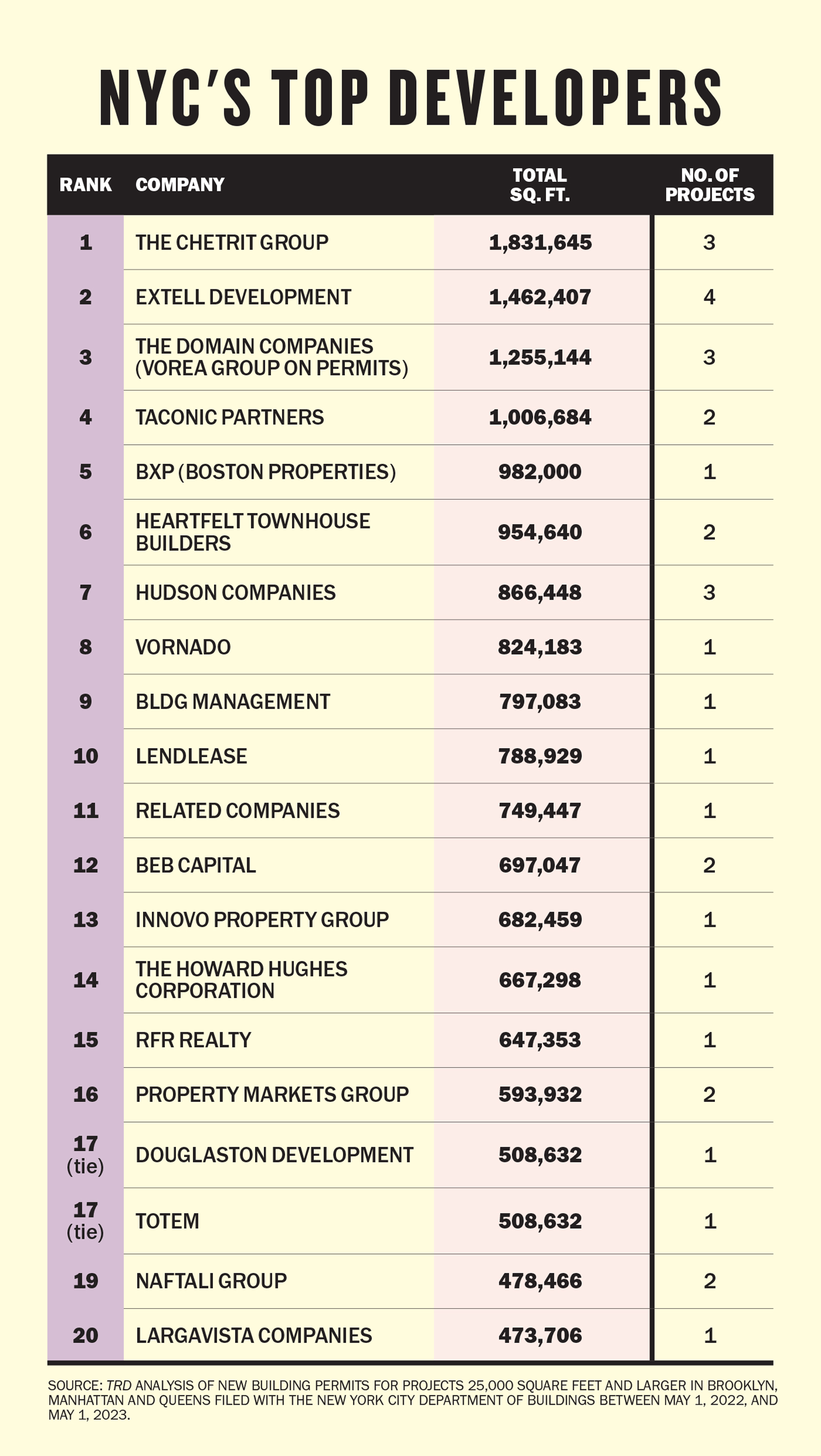

In the 12 months preceding May 1, the city’s 20 most active developers filed plans for 16.7 million square feet of new development — nearly a million more than in the previous year-long period.

To gain a clearer picture of which developers have the most skin in the game in the coming years, The Real Deal analyzed all new building filings submitted to the Department of Buildings between May 1, 2022, and May 1, 2023.

For the second year in a row, Moroccan émigré Joseph Chetrit’s eponymous firm topped the list, filing plans to develop just shy of 2 million square feet across three new projects. Its plans included the largest filing in the city: a 71-story mixed-use skyscraper with allotments for affordable housing on a Two Bridges development site that Chetrit Group bought from CIM Group and L+M Development Partners for $100 million in 2021.

Also included in the firm’s count is 100 West 37th Street in the Garment District, where Chetrit filed plans for a 360,000-square-foot, 68-story tower.

Gary Barnett’s Extell Development placed second, plotting out four new developments that combine for an estimated 1.5 million square feet. Extell’s major projects include 259 Clinton Street, a 421a-approved, 62-story tower just a block from Chetrit’s Two Bridges site. On the Upper East Side, Barnett’s firm filed more plans for a 30-story, 400,000-square-foot medical tower at 403 East 79th Street, also known as 1520 First Avenue.

Rounding out the top three was Domain Companies, which filed plans for nearly 1.3 million square feet across three multifamily projects. Those included a 500-unit complex at 2-33 50th Avenue in Long Island City and two Gowanus projects: a 360-unit, two-tower development at 420 Carroll Street and a 241-unit building at 545 Sackett Street.

Multifamily limbo

The end of 421a last summer created a host of challenges for developers. For those who managed to get foundations laid in time to qualify for the tax break, the 2026 construction deadline now looms large. Some worksites across the city could face supply-chain hiccups that could have a devastating effect.

“I think it’s at the point now where the deadline is getting a little bit close for comfort,” said Domain Companies co-founder Matt Schwartz.

Hopes fluttered and then faltered over Gov. Kathy Hochul’s housing plan, which sought to address some of these challenges but failed to garner enough support from state lawmakers. Entering summer without an immediate replacement for 421a in the cards, developers say they’re focusing on projects already in their portfolio rather than reaching for the horizon.

“If we don’t have something in the pipeline and advancing, we’re generally stuck in a kind of wait-and-see mode. Which is unfortunate, given where we are,” Schwartz said. “We’re very bullish on New York, but the affordability crisis is a real threat.”

“Those that aren’t prepared to proceed to hit the deadline are going to be hurt,” added Lee Brodsky, CEO of BEB Capital, which placed 12th on the list with nearly 700,000 square feet across two projects.

Developers who find themselves unable to meet the deadline will have to find other solutions for their overpriced land, with possible pivots toward condos or luxury rentals.

Sign Up for the National Weekly Newsletter

SIGN UP

By signing up, you agree to TheRealDeal Terms of Use and acknowledge the data practices in our Privacy Policy.

Uneven office

Life in the city is showing signs of a somewhat comfortable new normal. Tourists have returned en masse, subways are sardine-packed and the majority of faces you see are maskless. Meanwhile, most industries have returned to their pre-pandemic levels of activity.

Less comfortable is the number of workers who are going back to the office. Despite growing demands from executives at major corporations like Disney and Google, only 42 percent of companies have required employees to return to the office full-time in the second quarter of 2023, according to the Flex Report, which collects data from more than 4,000 companies across the U.S.

Still, one aspect of New York City’s office market that’s quietly thriving, developers argue, is the premiere workplace landscape.

Across Manhattan, developers are forging ahead with earlier projects (filed before the time period covered by this ranking), including RXR’s 1,600-foot-tall tower at 175 Park Avenue that is slated to offer more than 2 million square feet of office space along with 500 hotel rooms, as well as Boston Properties’ nearly

1 million square foot office tower on the site of the MTA’s former headquarters.

“The occupancy rates around the Plaza District, particularly Park Avenue, are very, very strong,” said Hilary Spann, an executive with Boston Properties’ New York division, which placed fifth on the ranking thanks to its largest project at 343 Madison Avenue, just north of SL Green’s One Vanderbilt.

Commercial tenants looking for more than 100,000 square feet of space are struggling to find available properties with modern amenities worthy of bringing their employees back to the workplace, according to the developers TRD spoke with.

“We’re even hearing stories about tenants being displaced from their buildings by other tenants that are larger and expanding, and sort of having the smaller tenant scramble to find space,” Spann said.

Winners and losers

Looking ahead, developers predict that interest rate anxiety will be the driving factor impacting their prospective portfolios.

Uncertainty around interest rates compounds uncertainty in the market, developers argue. Real estate prices, which are based on the underlying spread of interest rates, have become increasingly difficult to predict in the turbulent market.

The answer to that problem is stability, but developers aren’t hopeful that’s coming anytime soon.

“That’s probably not going to happen in 2023,” said Spann. “It’s going to take a little while for everybody to digest the end of interest rate rises.”

But the lagging impact of interest rate hikes could create opportunities for deep-pocketed developers.

“The reality is, when interest rates rise like they have and loans expire, most owners who bought in the last 10 years have to pay down their loan in some capacity,” BEB Capital’s Brodsky said.

“I don’t believe that every owner is going to have the liquidity for those paydowns. And there’s going to be an opportunity for folks to enter those ownership groups at an optimal value that will lead to greater upside in the future.”