98 new dev contracts, 9 boutique dev launches in the borough last month

Sep 5, 2024, 2:00 PM

By Jake Indursky

The summer has been a confounding one for new development, with the luxury market slumping and Manhattan and Brooklyn showing no clear trends.

That behavior continued into August in which Brooklyn saw contracts spike year-over-year, the luxury market sputtered and Manhattan held its ground, according to Marketproof’s monthly report.

The city saw a total of 246 contracts signed last month, up slightly from 236 deals last year. The median price per square foot was down 11 percent to $1,550, and days on market fell 4 percent to 119.

Marketproof CEO Kael Goodman said that following the mixed signals in August, the next few months should provide a “clear answer” on how buyers are reacting to falling mortgage rates. At the end of August the average 30-year fixed mortgage was 6.35 percent, the lowest it’s been since May 2023.

And while demand was up slightly, inventory ticked down to 10,532 available units as no new Manhattan projects came online this quarter. Meanwhile, in Brooklyn, nine boutique projects launched, adding 69 units, and in Queens four projects added 87 units.

Jason Thomas, senior vice president of research and analytics at Brown Harris Stevens Development Marketing said development launches in the outer borough have a “quicker launch cycle” than Manhattan projects.

Manhattan saw 123 new development contracts signed in August compared to 116 last year. The median asking price was $2 million and the median price per square foot was $2,084.

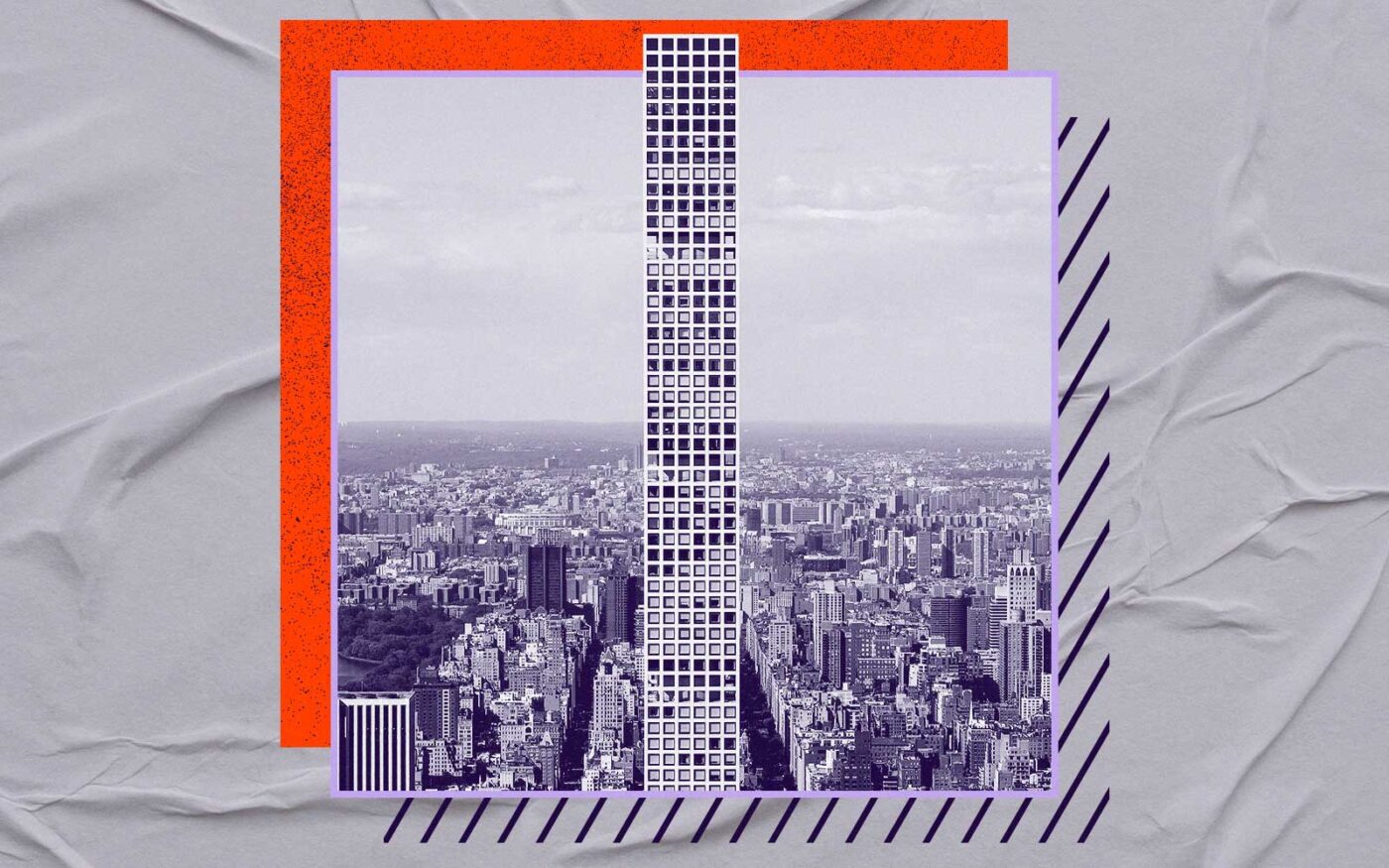

520 Fifth has continued to be Manhattan’s standout project, signing nine contracts on one- and two-bedroom units. Rabina’s 99-unit supertall has now sold 61 percent of its units after netting an additional 21 contracts in July and 27 in June.

Thomas said the building has capitalized on the prestige of a Fifth Avenue address and its reasonable price per square foot. Of the non-penthouse units currently listed on StreetEasy, most don’t crack $3,000 per square foot. Corcoran Sunshine Marketing launched sales for the building in April.

Sign Up for the National Weekly Newsletter

SIGN UP

The luxury market had its third straight month of declining deals, with 24 contracts signed at $4 million or more, two less than last August.

For a third straight month, 50 West 66th Street led the luxury market, signing four more contracts over $4 million in the 121-unit building. Extell Marketing Group, with the support of The Corcoran Group and Douglass Elliman, is leading sales for the project.

After a meandering start to the summer, the Brooklyn new development market ended with a bang as 98 deals were signed in the borough, a 28 percent increase compared to last year. Deal volume signed in the borough was the highest since May 2023. The median asking price was $1.3 million and the median price per square foot was $1,299.

“I think that Brooklyn is starting to really sort of outpace Manhattan,” Serhant head of research Coury Napier said of the borough’s quickening pace of signings.

Kensington Manor, a new 76-unit project at 428 East 9th Street, led Brooklyn with 10 contracts on studio and one-bedroom units. Goodman said that entry-level units like the ones at Kensington Manor, which are priced between $370,000 and $590,000, have been selling well. Corcoran’s Danielov Team launched sales for developer ZHL Group two months ago.

While the 24 contracts signed in Queens was one more than last month, it was nearly half as many as the 43 signed in August last year. The median price was $923,000 and the median PPSF was $1,196.

The Vela, a 29-unit project in Astoria, led the borough with four contracts on one- and two-bed units.

Serhant launched sales in November of last year.

319-321 West 38th Street. Designed by Gene Kaufman Architect

319-321 West 38th Street. Designed by Gene Kaufman Architect 25 Cottage Street. Designed by Handel Architects

25 Cottage Street. Designed by Handel Architects

Gowanus Green. Designed by Marvel Architects

Gowanus Green. Designed by Marvel Architects

520 Fifth Avenue. Rendering courtesy of Binyan Studios

520 Fifth Avenue. Rendering courtesy of Binyan Studios