Editors Note: We wanted to bring attention to a friend and business associate Dean Marchetto. A relevant force and promoter of Jersey City and all the design standards he has worked to instill and enforce in our way of architectural progress in Jersey City. Dean has remained consistently professional, forward thinking and a proponent of the highest values of his profession. To our friend, Congratulations!

AUG 28, 2023, 10:00 AM

By Brand Studio

Jersey City has always had a great view of the Manhattan skyline, but in the last 15 to 20 years, the city across the Hudson River has developed an impressive skyline of its own. Dean Marchetto is the founding principal of MHS Architecture, an award-winning architectural firm with a strong focus on urban planning and design. The firm, formerly known as Marchetto Higgins Stieve, has been based in Hoboken for more than 40 years.

Marchetto and Michael Higgins, Managing Principal at MHS Architecture, spoke with The Real Deal about the increasing number of high-rise developments in Jersey City — and how they’ve adapted to meet developers’ changing needs.

“Up until maybe 20 years ago, New Jersey didn’t have much of a high-rise development market, so there were very few architects that had experience with high-rise development,” says Marchetto. “Being here for the past 40 years enabled us to gain that experience. Now, after getting a dozen or so of those buildings built, we’re experts. We’ve become the high-rise guys in New Jersey.”

Development that originated along the Jersey City waterfront has spread to nearby neighborhoods including Journal Square and Bergen-Lafayette. Higgins notes that the MHS project 270 Johnston, a new mixed-use 24-story residential tower in Bergen-Lafayette, is now the tallest building in that area.

With a planned $100+ million renovation of the historic Loew’s Jersey Theatre, and the Centre Pompidou x Jersey City scheduled to open in 2026, the city is primed for a cultural renaissance. Higgins says, “The biggest change is that Jersey City was once a bedroom community for New York, and now with these cultural institutions getting constructed, it’s becoming more of a thriving metropolis.”

Developers view Jersey City as a great place to invest, and Higgins believes the city’s mayor deserves credit for that. He says, “Steve Fulop has provided excellent leadership over the past decade, and it’s really transformed the city, including not just the high-priced downtown waterfront neighborhoods, but all the neighborhoods in the entire city.”

Mayor Fulop speaks highly of MHS as well. “Marchetto Higgins Stieve Architects have been essential to the growth and development of Jersey City,” he says, explaining, “They were engaged in collaboration with our Planning Department long before most developers believed the growth was even possible. They have had a hand in much of the progress over the last 25 years here in Jersey City and are extremely well respected.”

A Wealth of Local Knowledge and Relationships

Jersey City has seen an influx of New York developers, and it’s common for them to seek guidance from locals as they navigate the challenges of working in a different state. Higgins says, “The New Jersey market is different than the New York market, but that’s where our local knowledge of the market trends, local codes, and everything else comes into play and adds value to the project.”

For example, residents along the New Jersey waterfront love their Manhattan views. With each new project, the MHS architects make those views a priority. Typically, when a tower is built, only one side has the preferred view. In comparison, a stepped design extends each apartment further out as you move back in the building, giving three sides great views of New York City and the Hudson River. “You create value when you create views. Many of our plans are oriented around creating views and doing it with a simple elegance that appears effortless and beautiful,” says Marchetto.

From the beginning, MHS has focused its work on urban areas of New Jersey.

“We’re urbanists,” Higgins explains, “We focus on transit-oriented developments, downtown development, and placemaking. We do everything from building design to urban design and urban planning.”

Both Dean Marchetto and Michael Higgins reside locally — Marchetto has lived in the area his whole life, while Higgins has been there 30 years. They understand the urban landscape not just on a professional level, but also a personal one. This makes it easy for them to communicate its appeal, including walking to restaurants and the light rail, to developers looking to attract buyers and leasers. Marchetto says, “Living the urban experience in this area allows us to advise our clients better.”

MHS clients also benefit from the team’s long-standing relationships with members of the local community, including zoning and planning officials, the building department, consultants, contractors, and neighborhood groups. Because of its vast local network, MHS is often asked to recommend land-use attorneys, civil engineers, and other industry professionals.

Marchetto says, “We’re able to advise our clients on assembling the best team of professionals for a particular project or location, and who has the best rapport and relationships. Developers need guidance when they’re working in a new area, and we’re happy to help.”

The firm’s extensive experience working in New Jersey gives them a deep familiarity with the entitlements process. When developers want to build in Jersey City, Newark, Bayonne, or Hoboken, they typically want to build as big of a building as they can get approved on their property. Knowing the approvals process and zoning precedents helps MHS position its clients in front of municipal boards in the most favorable and effective way.

For example, they recently worked with three developers — the Albanese Group, Silverman Neighborhoods, and Liberty Harbor Development — on a Jersey City project called the Hendrix, a 40-story structure with about 482 residential units, a state-of-the-art black box theater, and an art center. Marchetto says, “The zoning for that area allowed a 40-story building because of a zoning bonus for the give-back to the arts.”

When the units in the Hendrix went up for lease, they went so fast that the website had to be shut down temporarily. As the national housing shortage continues, Marchetto believes that Jersey City is in a great position to use that as an incentive for further development of the city, its infrastructure, and its placemaking.

Guiding the Redevelopment of Journal Square

As MHS earned a reputation for doing great work, the firm’s projects have grown in size. The Journal Square Redevelopment Plan, MHS’s largest project to date, is also one of the biggest single development areas in New Jersey history. Journal Square was once the historic center of Jersey City, but it was left behind when the waterfront took off during the mid-1970s. In order to reinvigorate the 244-acre area, the city’s previous administration and the Jersey City Redevelopment Agency, headed up by then-director Bob Antonicello, initiated a redevelopment process.

MHS, working alongside renowned planner Tony Nelessen got the contract and produced a vision plan encouraging a comprehensive development that includes walkability, sustainability, transit-oriented design, and putting density where transit is in order to reduce dependence on the automobile. Their plan became the Journal Square 2060 Redevelopment Plan and legal zoning document for the entire district.

Today, Journal Square developers feel like the sky’s the limit — and as it turns out, that’s relatively accurate. Marchetto shares, “It’s probably the only plan I’ve ever seen where the height limit is unlimited. If you look in the zoning, there’s no height restriction in the city’s central core, so you can build as high as the Federal Aviation Authority will allow you to build.”

When developers looking to build in Journal Square need architectural services, they often reach out to the authors of the plan.

Marchetto says, “Combining our architectural experience with the planning knowledge gives us a unique advantage.”

MHS is working with Eliot Spitzer on the development of 425 Summit Ave, a high-rise mixed-use multifamily development in Journal Square. It’s Spitzer’s first development project in Jersey City, and he appreciated the company’s guidance. He says, “MHS was superb in so many ways — their sense of aesthetics is wonderful, their understanding of Jersey City unrivaled, and their ability to navigate the local entitlement process unmatched. I could not have been happier in every way in our relationship.”

After working locally for more than 40 years, the MHS Architecture team has comprehensive knowledge of every aspect of the process. “There is no substitute for experience when it comes to getting things done,” Marchetto says. “In the past when New York developers came into New Jersey they brought their own architects. Today that is no longer necessary. MHS offers the same creativity and depth of service, along with the local expertise needed to maximize the profitability of your project.”

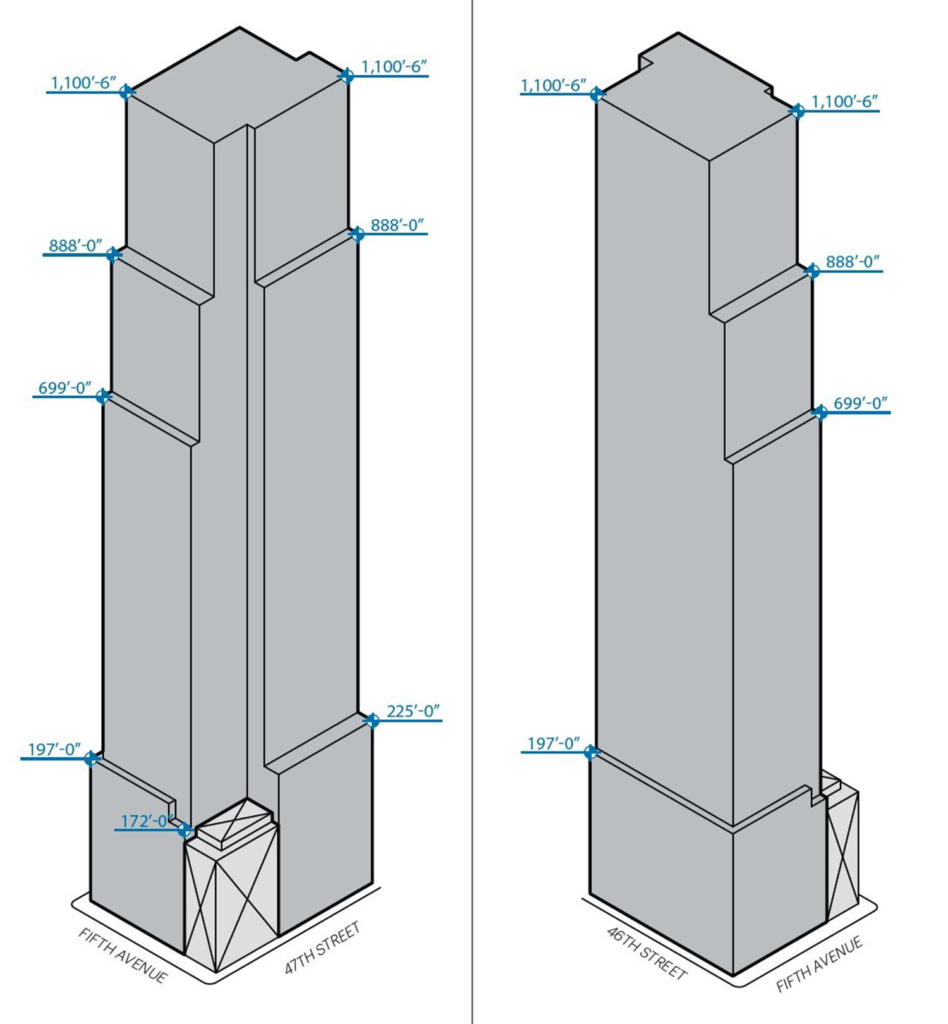

570 Fifth Avenue as an office (left) and mixed-use residence and hotel (right).

570 Fifth Avenue as an office (left) and mixed-use residence and hotel (right).