The largest filed in January was for a massive office in Kips Bay

New York /February 10, 2020 09:00 AMBy Eddie Small Research by Yoryi de la Rosa

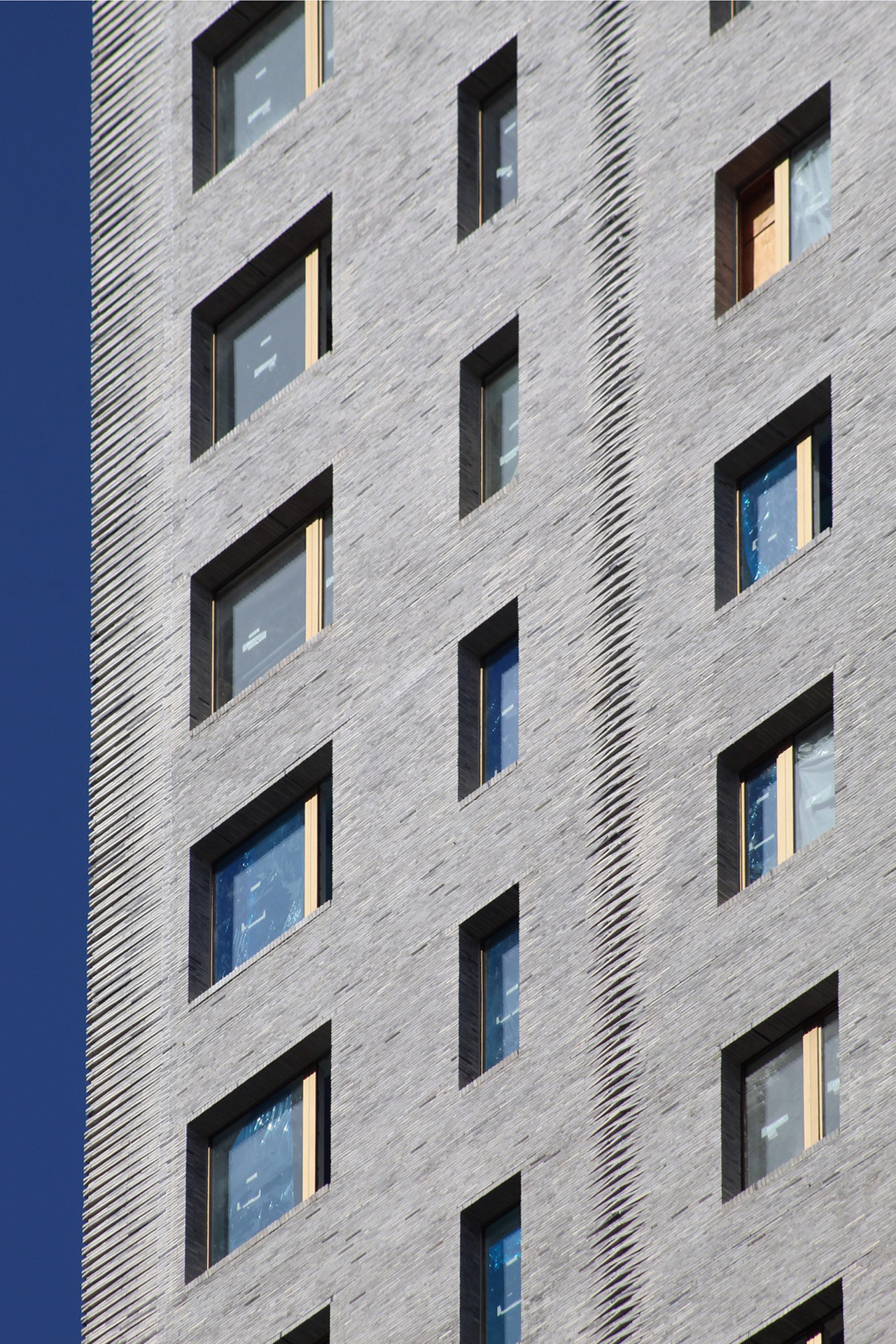

Clockwise from the top: 500 East 30th Street, 1 Ellis Street and 2555 Broadway (Credit: Google Maps)

New York’s life-sciences sector got a major boost last month.

A roughly 418,000-square-foot building from NYC Health + Hospitals in Manhattan’s Alexandria Center for Life Science was the largest project filed in January — by a wide margin.

The second largest, Gary Barnett’s 22-story mixed-use development by 97th Street and Broadway on the Upper West Side, was almost 200,000 square feet smaller.

The 10 largest filed last month included projects in Queens, two in Manhattan, two in Brooklyn and one in Staten Island.

1. 500 East 30th Street, Manhattan

The largest building plan filed in January was a 417,734-square-foot office property in Kips Bay from NYC Health + Hospitals. It will stand 21 stories and 384 feet. It is part of the third phase of the Alexandria Center for Life Science, according to YIMBY.

2. 2555 Broadway, Manhattan

Gary Barnett’s Extell Development plans a 22-story project by 97th Street on the Upper West Side spanning 224,945 square feet. The development will have 215,866 square feet of residential space and 9,080 of commercial, and 130 residential units. Extell finished its assemblage for the project in 2017 by closing on 262 West 96th Street for $80 million. The property was previously home to a Gristedes supermarket.

3. 1 Ellis Street, Staten Island

A storage facility in Tottenville spanning 146,364 square feet grabbed the No. 3 spot. The structure from Charles Brown’s Ellis Storage LLC will stand three stories and 37 feet tall.

4. 88-20 153rd Street, Queens

The largest Queens project filed last month is from the Chetrit Group on its Mary Immaculate Hospital site in Jamaica. The residential building will span 132,085 square feet with 207 residential units, and it will stand 80 feet and eight stories tall. It is the fifth building the company is planning for the hospital site, along with a four-building, 481-unit complex at 150-13 89th Avenue.

5. 136-18 Maple Avenue, Queens

This mixed-use project in Flushing from developer Vicki Zhi will span 105,621 square feet and have 68 apartments. The project will include commercial and community space, and stand 14 stories and 147 feet tall. The building is one of many mixed-use developments on its way to the neighborhood.

6. 134-11 221st Street, Queens

The third Queens project to make January’s list comes from Myron Berman: a 72,130-square-foot building in Jamaica with 64,642 square feet of residential space and 7,488 square feet of industrial. It will stand four stories and 42 feet tall and have 81 residential units.

7. 35-01 36th Avenue, Queens

This mixed-use building in Astoria comes from the real estate company AKI. The 10-story project will span 43,423 square feet, split between 33,375 square feet of commercial space and 10,048 square feet of community space. It will stand 179 feet tall and feature nine parking spots.

8. 408 Lefferts Avenue, Brooklyn

The biggest Brooklyn project filed in January is a mostly residential building from United Elite Group in Prospect-Lefferts Gardens. The development will span 43,129 square feet, divided between 40,110 square feet of residential space and 3,019 of community space. It will stand six stories and 65 feet with 56 residential units.

9. 397 Kingsland Avenue, Brooklyn

This 40,000-square-foot Greenpoint parking garage is from the film and production company Broadway Stages. It will stand 35 feet tall and have 150 parking spaces.

10. 17-11 Hancock Street, Queens

January’s list closes out with a project in Ridgewood. Leo Kaufman filed plans for a 39,673-square-foot residential building that will stand seven stories and 70 feet tall with 60 residential units.