In an extensive interview, the Kushner Companies boss gets candid about 666 Fifth, federal investigations, tenant-harassment allegations and his son in the White House

Laurent Morali and Charlie Kushner (Credit: Sasha Maslov for The Real Deal)

Charlie Kushner has a few things he wants to get off his chest.

Bombarded with investigations into his family’s business dealings since his son, Jared, became a senior advisor in the Trump administration, he’s out to squash critics who suggest his multibillion-dollar real estate empire is faltering.

On May 23, the Kushner Companies patriarch, who founded his firm more than 30 years ago, sat down with The Real Deal to respond to the flood of reports about his firm’s finances, attempts to raise money in China and corruption concerns raised by ethics watchdogs — in his words, “jerks” that “can’t get a real job.” He also talked at length about his prized but overleveraged office tower 666 Fifth Avenue.

For years, his firm struggled to find investors for the 1.5 million-square-foot building, which has a $1.2 billion mortgage coming due in February. Talks with Chinese and Qatari investors raised concerns over conflicts of interest, but Charlie and the firm’s president, Laurent Morali, say some real estate and financial firms saw opportunity in the negative attention because they saw past the “headline risk.”

In May, Brookfield Property Partners agreed to buy Vornado Realty Trust’s 49.5 percent stake in the building, which Charlie and Laurent say will pave the way for a new loan very soon. And despite the negative press, Charlie says his firm will close over $2 billion in financing in the first half of 2018 and that “business is plowing ahead like a bulldozer.”

We meet Charlie; his wife, Seryl; his daughter Nicole; Laurent; and their publicist Christine Taylor on the 15th floor of 666 Fifth, where a young staff tends to the Kushner family’s vast portfolio, surrounded by a few glass-partitioned offices. After shaking hands, Charlie, 64, quickly breaks decorum.

“Are you guys going to be assholes today, or are you going to give us a fair shake? Because you’ve been assholes in the past,” he tells these two reporters.

“Do you want me to throw you out of here now? Because I will,” Charlie adds. “Then you can write whatever the fuck you want about me.”

But in the subsequent hour-plus interview, he and Morali have plenty to discuss.

Charlie commends what his son and daughter-in-law, Ivanka, “sacrificed to go into government” and tells us that if he had to register today, he would “probably register as an independent.”

He admits that meeting Qatar’s finance minister three months after President Trump’s inauguration was a mistake — though Kushner Companies is not “forever going to be prohibited, have a conflict of interest,” he says. He insists that the ongoing investigations into his company are “politically motivated” and not something he worries about. He claims that two of those investigations have been dropped.

And he isn’t afraid to single out local elected officials when he thinks their decisions are politically motivated, as he did in both Brooklyn — in connection with a three-acre site in Gowanus — and Jersey City.

“I was friendly with [Jersey City Mayor] Steve Fulop and we were supportive of him when he was considering running for governor,” he says. “But now I think he’s just another New Jersey asshole politician.”

This interview, for the cover story of The Real Deal’s June issue, was conducted on May 23. It was condensed for brevity and edited for clarity.

Let’s talk about the building we’re in right now. Can you tell us a little about how you began the talks with Brookfield?

Charlie Kushner The talks with Brookfield probably — there’s so much media attention on the building that some people saw the negativity as an opportunity, and Brookfield is one of those people, one of those institutions that have experience repositioning buildings. We had, we have a long-standing relationship with Brookfield specifically Rouse [Properties], which is one of the companies within Brookfield. But we like them, we like their culture, it’s very similar to our company culture. … They saw something in a repositioning of this asset that was consistent with what we felt was a good opportunity as well.

They saw the negativity as an opportunity?

Charlie Kushner They see a building being emptied, the owners about to lose it because the debt is going to mature. All the bad things that have been written about this building, they saw it and understood the true positioning of what we’re trying to do here and they saw it as an opportunity to go ahead and make the asset equivalent to the location. Because right now, the asset is not equivalent to the location.

Laurent Morali A result of all the bad press-slash-negativity covering this particular asset – we got a lot of inbound inquires saying, “Hey, what’s going on with this building? Can we be helpful?”

Charlie Kushner “Can we give you debt?”

Laurent Morali “Can we give you debt? Can we be partners? What are your plans?” It actually triggered some discussions and so that’s really how it started.

Did all of this negativity, as you called it, also limit the pool of potential investors? Like were people scared off by the press coverage and the attention that any investment might bring?

Charlie Kushner Definitely. People who would ordinarily find it as an opportunity wouldn’t want to be part of it because they didn’t want the headline risk; there was that within people too. And we saw that right away: who was interested and who was not interested.

Do you plan on bringing other equity into the building?

Charlie Kushner No. We are working on the financing. We have several proposals from several well-known institutions that are in the process of issuing us term sheets.

And how big of a loan are you in talks for?

Laurent Morali I’d rather not talk about that for now, if you don’t mind.

It’s true that you’ve shelved the original 1,400-foot condo-hotel-retail plan, correct?

Charlie Kushner That’s correct.

Are you still thinking about some combination of residential in some part of the building?

Charlie Kushner The plan entails making this 1957 [office] building into a 2018 [office] building with floor-to-ceiling windows, convector units, reskinning the building, upgrading elevator, lobby, and really making this a building of the quality equivalent to the triple-A location where it sits.

The old plan – we did scrap – which the press has reported as crazy or unattainable – our logic, it was not a crazy logic at all. When we looked at the idea of putting Humpty Dumpty back together again, and capturing both the retail and the building and merging them again, we looked at what we have and looked at how many full blocks of property that are there on Fifth Avenue and you say: This dirt is worth more than the buildings. So with the possibility of repositioning and re-massing the asset, the square footage — we think it’s a brilliant plan. There are other people that also thought it was a brilliant plan.

We had term sheets signed for several billon dollars of equity, but it’s such a big project and would require so much sovereign funds that it’s just not something that we can execute without creating a lot of havoc. Our company now is committed to steering clear of any conflict. It’s not a question; we don’t ask ourselves, “Is it legal”? or “Are we allowed to do it?” We ask ourselves, how is it going to be perceived and spun by the press, and what damage could that cause our company, our bankers, to Jared in Washington, because of more noise that is unnecessary. So we have opted, intentionally, not to do things that we’re absolutely legally permitted to do, and have done in the past.

So you’re basically saying that this project would have been impossible without sovereign wealth funds as investors?

Charlie Kushner It would have been very challenging without sovereign, the people we had term sheets with were either sovereign wealth or government connected.

Can you tell us who was ready to do the deal? Who was signed on and wanted to get it done?

Charlie Kushner Well it was known, we spoke well before President Trump was considering a run. At first when we conceived the idea, we spoke to …

Laurent Morali HBJ [Former Qatari PM Hamad bin Jassim bin Jaber Al Thani].

And there was a term sheet signed there?

Charlie Kushner We had the term sheets signed. Now he was very interested since Day One. And he actually saw the evolution of this project, but he’s the former Qatari prime minster. He’s certainly connected with the government. There’s no law that we can’t do it, but we want to stay away from any potential ethic claims. And we said, “We’re not doing it.”

There’ve also been reports that Anbang Insurance Group was going to invest. How close did you get to a deal with them?

Charlie Kushner We got very close and they also signed the term sheet, and were very – and they wanted to proceed. Their interest also stemmed before the presidential [election], they were in this office very interested, they obviously follow, are interested in very high-profile projects and expressed interest before Donald – President Trump – was ever a contender.

Why did they ultimately walk away?

Charlie Kushner The whole plan got scrapped because we saw where it was heading. We saw us doing an EB-5 application, an innocent EB-5 application, where we had done it in the past – everybody else does it – but we saw that the blowback we got just for doing something that we are allowed to do, and have done. And everybody else does. People have called us a lot of things, but people haven’t called us stupid. We saw that this isn’t going to lead to a good thing or have good consequences for anybody. And I am concerned about the ramifications. We’ve created a very concrete barrier wall between us and Jared in Washington, which is what was required ethically, and we’ve done that successfully.

Do you think that blowback was justified? In hindsight, was it a mistake to do this roadshow in China?

Laurent Morali I’d like to do this one.

Charlie Kushner I have to answer that one, too. Because it was so crazy unjustified ‘cause we did nothing different than anybody else did except the press picked it apart to say, “They’re showing a picture of President Trump in the background.” But nobody knows –because you guys don’t report it – that every application shows a picture of the president in the background. So if President Obama was president, it would have his picture. If it was the next applicant, it would be there for the next applicant. We didn’t set up the presentation, it was done by the local Chinese group so the fact that it was jumped upon with an innocent comment [by Nicole] of “my brother left to go to the administration” is beyond a feeding frenzy…there is no bad intent in that statement or in our presentation. But yet, I hate to say you guys, because it’s you guys and the media, jumped on it to say, “Oh my God, this is so ill-intended.”

And I also want to point out, the U.S. attorney opened an investigation on us, right? You know what they told us, as of in the last month? That the investigation is not active anymore because there’s nothing there. They are not investigating us anymore.

They said they’re no longer investigating you?

Charlie Kushner Yes!

That was how long ago?

Charlie Kushner Last month or two. I don’t know if I’m allowed to tell it to you, but you want the truth, I’m going to tell you the truth.

And did they say not to expect any further inquiries or subpoenas or–

Charlie Kushner Yes. They said it’s done.

And did they give you any conclusions?

Laurent Morali The bottom line is we did nothing wrong, the bottom line is if the EDNY [U.S. Attorney’s Office for the Eastern District of New York] wants to ask us questions, they can always ask us questions. We welcome anyone’s questions. We know we did nothing wrong and I think that’s the conclusion that everybody’s coming to.

(A spokesperson for EDNY declined to comment.)

One of the things that was mentioned in some of those early reports on the roadshow, apart from the presentation was the third party company mentioned, Qiaowai [Group], was making some sort of assurances to the attendees that the president would be greenlighting the project–

Charlie Kushner & Laurent Morali We don’t speak Chinese!

(Family erupts in laughter)

Charlie Kushner How the hell do we know what they were saying? We don’t know those people, we don’t know what they were talking about.

Laurent Morali We did not present anything.

Charlie Kushner We can be responsible for our actions.

Laurent Morali First of all, understand one thing, it’s not our show, it’s someone else’s show. We showed up to talk about our project, that’s what we did, okay? So what they said in Chinese, I have no idea.

About your project.

Laurent Morali I’m sorry?

About your project.

Laurent Morali What they said in Chinese? I don’t know. Like I said, I don’t know what they said.

(Editor’s note: The Kushners recently sold a Gowanus, Brooklyn development site for $115 million to Aby Rosen’s RFR Realty. They had originally planned to develop a mixed-use project there of up to 300,000 square feet.)

The sale came after local City Council member Brad Lander said that he basically wouldn’t approve a rezoning of the neighborhood if you guys, in any way, benefited from it. Was that sort of the death knell for the whole thing?

The sale came after local City Council member Brad Lander said that he basically wouldn’t approve a rezoning of the neighborhood if you guys, in any way, benefited from it. Was that sort of the death knell for the whole thing?

Laurent Morali I’ll tell you that it’s a very good example of a politician making a statement not knowing what he is talking about, other than it’s discrimination because Jared Kushner has no involvement with this project since he left for the White House.

Charlie Kushner The direct answer to your direct question is it definitely did impact. We have had issues, specifically in two towns. One in Gowanus, where they made it clear that they don’t want Trump, because my son works in the administration. They tie it together and say we don’t want to give a Trump-related project; we’re not going to approve them. We think it is discrimination, we think it is unfair. But we decided in the best interest with our partner, let’s just move on.

The other place where we had that same sentiment, which was local politics, was Jersey City. You know, again, you guys want to come to the truth. I’m going to tell you good things, I’m going to tell you bad things. That’s probably the most negative thing that’s impacted our business.

In Jersey City also, they switched on a dime because they were pandering to the Trump haters and connected us to the Trump haters. And giving us tax abatements, he [the mayor] felt, would not be good for him politically, and he switched on a dime.

Mayor [Steven] Fulop said that you missed a construction deadline of January 1 and you are tardy or have defaulted on fees that are owed to the city.

Charlie Kushner But it’s just not true.

Laurent Morali There’s nothing to talk about, Will. I’m serious, it’s wrong. He came out publicly, I forgot the exact wording so please don’t quote me on this, but you can find his tweet. He said something along the lines of “any Kushner-related project in Jersey City is dead on arrival,” something like this. Right? That’s what he wrote. That’s his motivation, local politics, that’s all it is.

(Editor’s note: Fulop said the 1 Journal Square project, as proposed, was “DOA,” not that just any Kushner project was.)

Charlie Kushner Laurent, let’s answer the question. The question is you miss a payment; you’re talking about an $800 million building. We read in the paper, it was a $40,000 payment and we have tens of tens of millions of dollars in the project. We look at each other and say, “What payment did we miss? Was it our partner that missed it? Did we miss it?” We couldn’t find it. I’m still not clear what payment we missed, okay? If we missed a payment of $40,000, did we get a follow-up letter? – “You guys, you missed a payment.” That would happen in normal course of business. They weren’t looking to, like, give us a break. I still don’t know what that payment was or who missed it. We asked everybody, asked our partner.

The second thing in terms of the developer’s agreement that we’re in breach [of], we were proceeding to modify the developer’s agreement, diligently with the town. They absolutely were okay with everything. The election came, they say you’re in breach of your developer’s agreement. It turned like a dime. [snaps fingers]

And for full transparency, the mayor of Jersey City, who’s just the local … you know, typical New Jersey politics. He had me, I was on speaker phone here. He said “Charlie” — This is before he was running and realized he had to pander to the Trump haters, he was on speakerphone, and I had people in the room, very credibly, who will certify this or give affidavits to this – “Charlie, this is blatant discrimination. This is discrimination. No different than I’m not giving you a PILOT program because you’re black, because you’re a Jew, because you’re a woman.” As a matter of fact, he referenced me to a case. “Charlie, there’s a case, I think it’s Hovnanian vs. Equitable. Where one party had it, one party didn’t have it, and the city lost.” And, he said to me, “Charlie, if you decide to sue me for discrimination, I am not going to defend it.” And you take all of this and weigh it to when the local election comes, the Trump haters make a lot of noise, he realizes he has to pander to Trump haters and (claps hands together) we hear about the $40,000 bill that wasn’t paid, we hear about breach of developer’s agreement. You want to know what it really is? It’s bullshit.

(A spokesperson for Fulop said “the terms of payment and fee schedules were outlined in the Redevelopment Agreement between the two parties at the start of this project– this is something that has been covered many times recently. We have no further comment.”)

Laurent Morali and Charles Kushner (Credit: Sasha Maslov for The Real Deal)

What is he saying has been breached in the agreement?

Charlie Kushner We were moving to modify another misnomer that’s been reported in the press, which is that WeWork left the partnership and left the building. It is absolutely false. We decided – I was a major part of that decision – to part with WeWork. The reason was, not any animosity towards WeWork. They designed such a specific, tailored building with this WeLive that I felt, if their concept was wrong, we would have to rebuild the building. This was a bastardized plan with common areas and connecting hallways and cafeterias and all this stuff, that if WeLive didn’t work there, and they don’t exactly have their game together, in my opinion, based on the way they planned it. So I felt, “Let’s go conventional, let’s get rid of WeWork.” And that’s exactly what happened. When we did that, we went to the city and said you gave us this kind of abatements, you gave of this kind of plan, we’re going to modify it. “No problem, no problem.” So technically, we weren’t in accordance with what we had agreed, but they agreed to modify. Until the election — “You’re in breach.”

(WeWork declined to comment.)

So what are you going to do next? Are you going to sue the city?

Charlie Kushner We’re seriously contemplating suing the city, yes. And we’re also thinking of some other ways to develop the property, the project.

What are some of those alternatives that you might consider?

Charlie Kushner Well they forced us to – ordinarily, we would do a union job, so we will certainly, with no tax abatements, we can’t afford to do the unions, which is about a 15 percent delta on the hard cost, so we’ll probably shift to do a nonunion job or a mixed-shop job, at best. And we’re also thinking of repositioning. My feeling about that property is that it’s a question – and it happens in Washington, as I just read the paper: People want to hurt other people more than do the right thing that’s good for their constituents. So right now, our property is the center of Jersey City. We are Front and Main Street. So for them to not want that developed, who does that benefit? The local citizens? Who is going to benefit? And if they force me to own that property for the next 100 years, and my great grandchildren develop it, it’ll be worth a zillion dollars more.

Did you have a prior relationship with Fulop?

Charlie Kushner I was friendly with Steve Fulop and we were supportive of him, supportive of when he was considering running for governor, but now I think he’s just another New Jersey asshole politician, truthfully. Do you got that quote?

Do you expect more of this kind of opposition in New York from elected officials?

Charlie Kushner We have given you the two cases where we felt this. We have not felt this any place else. …There’s not one deal that we tried to execute that we did not execute. There’s not one financing that we had to get financed or wanted to get financed, that we did not get financing.

Besides the complete overhaul of this building [666].

Charlie Kushner This building aside. And even this building. We’re going to get something that’s off-the-charts great. We have competition to finance this building. Over the first six months of this year – and we’ll do a tombstone so I don’t want to be specific today – over the first six months of this year we will have done over $2 billion of financing. I can look back over your reports: “Kushner can’t get financing on 65 Bay Street.” While you guys are reporting that we couldn’t get financing because you guys are like parrots, you just report what the other idiots say. While you guys are reporting the stupidity, we’re sitting in a conference with our company on a Tuesday morning and we’re reviewing seven proposals that we have for financing, and we’re reading the crap that you guys write. So it’s been, excuse my tone, but it’s been, you guys have tried to kill us every step of the way, but we are actually stronger and healthier today. Not that there’s not challenges, cause if I say there’s not challenges, it’s a lie. Because there are challenges: Jersey City is a challenge. It shouldn’t be. Gowanus was a challenge. It shouldn’t be. But generally, our business is plowing ahead like a bulldozer and we just keep moving forward. … On this building [666 Fifth],we’re going to get three [loan] quotes.

Are these big domestic banks?

Charlie Kushner Banks with money.

Laurent Morali Banks with money. They’re not sovereign.

You met with Qatar’s minister of finance, Ali Sharif al-Emadi, after Trump took office. And you told the press that you were offered this meeting, but you took this meeting as a courtesy. During the meeting, you told the minister you would not accept sovereign wealth money. But why take the meeting in the first place if the point is just to tell him that you don’t want to take their money? Why not just send a polite letter or something?

You met with Qatar’s minister of finance, Ali Sharif al-Emadi, after Trump took office. And you told the press that you were offered this meeting, but you took this meeting as a courtesy. During the meeting, you told the minister you would not accept sovereign wealth money. But why take the meeting in the first place if the point is just to tell him that you don’t want to take their money? Why not just send a polite letter or something?

Charlie Kushner In retrospect, you are right. We should have done exactly what you’re asking me, what you’re suggesting. Don’t forget Jared moving to Washington, he had to transition in about three weeks. None of us knew the rules of government or what we should do, what we shouldn’t do. We made a decision, wrongly, in the beginning, saying, “We’ll speak to people as long as we’re clear and honest with them and upfront with them that we can’t do business with them.” ‘Cause we’re not going to, we’re not forever going to be prohibited, have a conflict of interest.

But we realized after that meeting, that it was a wrong thing to do. And subsequently, if someone wants to call us from a sovereign fund or any way connected with any government, we will tell them that we can’t meet. “We just can’t meet. We hope you can understand. No offense. We cannot meet, and that’s the policy we’ve had.”

Are you open to taking sovereign wealth money once Jared is out of the White House? Or is this now a ban in perpetuity?

Charlie Kushner We’re not thinking about it and we’re not contemplating it. … Jared is in the administration. I don’t know what the rules and the laws and the conflicts are. I just know that we have decided that it’s off limits to us. We have acted very strictly to enforce that to the point where we tell all of our vendors, our contractors, whoever it may be, that we don’t want any affiliation because sometimes it can happen just by accident. Because you’re dealing with a party and they deal with a party, or that party deals with a party. So we’re as careful as we can be.

Had you been in any previous talks with Qatar Investment Authority or they came to you and said out of nowhere, no prior talks or relations?

Charlie Kushner I believe Jared had a relationship with them.

Laurent Morali We had met with several people who represented them in the past. The truth is we’ve never dealt with sovereign funds before. Some people have asked me, “Is it a big problem that you can’t deal with sovereign funds?” No, because we were not dealing with them before, practically speaking. But there was a prior relationship.

What we’re trying to understand is during the meeting did you discuss or talk about the possibility that Qatar’s sovereign wealth could invest with you in the future, once there’s no longer …

Charlie Kushner [Cutting off] No.

Laurent Morali No, no, absolutely not. Absolutely not.

Charlie Kushner We don’t bullshit around with people. And we’re very, very direct and we’re very transparent. And we just tell the truth. So we don’t play games. We make it clear that we can’t do business with you.

So you’d mentioned that the Eastern District of New York contacted you a month ago to say they are no longer–

Charlie Kushner Not me, our lawyers.

All right, contacted your lawyers to say they’re no longer investigating anything related to EB-5 and your company. There are some other investigations that are open, you’ve been subpoenaed elsewhere. There’s everything from the U.S. attorney’s office looking into a relationship with Deutsche Bank. The Department of Buildings and U.S. Attorney looking at building permits records. And there’s New York State Department of Finance looking at lenders…

Charlie Kushner Let me address it – DOB [Department of Buildings]? Same thing as the EB-5. They told us, you know, check the boxes. We mixed up checking the boxes. We take responsibility, we hired a third party. They’ve investigated it. They said, done, it’s over.

Who said “done and over”?

Charlie Kushner The DOB.

Have you had to hire more attorneys to deal with the requests and to organize yourself internally? Have you been doing internal investigations?

Charlie Kushner We’ve also had other lawyers, for sure. We’ve had to organize ourselves internally, ‘cause we’re not checking what we can give them. ‘Cause whatever they want, we’re giving them, and they see that you can have all the papers you want. Just tell us what you want and you got it. That’s how we’ve been dealing with it. Not that we don’t make mistakes because we do make mistakes. We’re a big company and they’ll find some mistakes. But they know there’s nothing intentionally. So, if anybody wants to ask us, any federal authority, we cooperate. That’s it.

Dealing with new attorneys, fielding these requests, hasn’t caused a significant strain on your day-to-day?

Charlie Kushner No. No, it hasn’t cause a significant strain because we feel we have no exposure. I know the difference between having exposure and having to react on a different level. And a lot of these things are indicating that they’re just shutting it down, or they have indicated that they’re shutting it down.

The DOB and the Eastern District for EB-5?

Charlie Kushner Yeah. I’m getting poked [by Seryl]. He asked a question. I don’t care if the lawyers are happy. He asked the question, that’s the honest answer.

Even now the office of the Special Counsel of Robert Mueller is said to be looking at foreign financing talks with your company–

Charlie Kushner That’s false.

Have they talked to you? Have they interviewed you?

Charlie Kushner It’s just fake news. It’s bullshit.

No one’s reached out to you from the Special Counsel?

Charlie Kushner No, nothing. Nothing.

Another thing on this topic has to do with your multifamily portfolio. You mentioned the DOB investigation, but what the stories about that were getting at was not just a matter of some misfiled paperwork, but what has been described by tenants who spoke with reporters as a pattern of harassment, targeting behavior–

Laurent Morali [Cutting off]: Well, it’s wrong. Again, we’ve been in business for 30 years.

Charlie Kushner Go into any building. You’re going to hear the same stuff. I’ve been in business doing the multifamily for about 40 years. There’s just a lot more tenants than there are landlords. And I never got a call, “Thank you for the nice apartment.” We have tens of thousands of apartments and nobody has ever called me to say, “Thank you for the heat, for the apartment, thank you for the nice kitchen counter.” But they call you if there’s a problem. Every landlord has this. We’ve been targeted vis-à-vis everybody. But we have the same complaints as everyone else has, but we haven’t done anything improper.

Never? Some of these complaints started before, I know, the spotlight was on your company. I mean, there were reports about you acquiring those buildings in the East Village, that the rate at which the tenants were leaving the buildings was significantly greater than what you would normally see in rent-stabilized housing.

Charlie Kushner I know what you’re talking about. They were complaining that we were creating dirt and creating noise.

Ceilings collapsing, that kind of thing.

Charlie Kushner Can I ask you a question? How do you fix a broken building if you don’t create dirt and noise? I don’t know how to do it. If you can figure out how to do it, let me know. We take these old buildings that have broken hallways and broken stairs. We’re going ahead and fixing the stairs and the ceilings, and everything. We’re doing it to harass the tenants or we’re doing it to improve the building? I just don’t know how to do it quietly. Maybe they want me to do it at night when they’re sleeping, but I don’t think they’re going to be happy about that either.

I guess the point I’m getting at is that it’s not just the DOB thing that happened recently — it’s been a few things that have together made people ask the question if there’s a broader strategy in regards to the lower-income tenants at your properties.

Charlie Kushner We are so careful. We train our managers to be so incredibly careful as to what they say to the tenants, how they say it to the tenants. We instruct them. They get legal advice and legal training. Now that doesn’t mean you’re not gonna have complaints. Tenants are very often like the Trump haters. They don’t like landlords and they don’t like paying their rent, and I don’t blame them. That’s almost every project and almost every landlord has it. It’s part of the business. We have to respect and appreciate our tenants, because that’s our source of revenue. We are required to give them their accommodations, so we try to respect them as much as we can, but we just can’t make everybody happy.

There are also reportedly investigations involving Deutsche Bank. To what extent does it impact your relationship with lenders or institutions that you partner with at all?

Charlie Kushner It doesn’t impact that we have a very, very good relationship with Deutsche Bank. Very good relationship. As a result of them being sued by the Justice Department, they say we can’t do business with you guys for the period because they want us to do business with them in the future. But we can’t do it because Jared is in the White House. … It could be, theoretically, a conflict and we understand it.

The [DOF] is reportedly looking into loans you have with New York Community Bank, Signature Bank, as well as Deutsche. They’re apparently looking at whether Jared is guaranteeing certain loans.

Charlie Kushner They can look from now until I’m 170 years old. It’s nonsense. Let them look. We welcome them to look. What do they want from our files? What do they want form the bank’s files? All of our banks have a called us and said, “Give them whatever you have” because it’s stupid.

Do you think a larger divestment from company assets on behalf of Jared could have prevented some of these things from happening?

Charlie Kushner No. Because we have a very big business with a lot of assets that are owned. We’re a private company, so we don’t disclose financial net worth and stuff. We have a lot of assets, a lot of net worth, and it’s inter-tangled with trusts, and kids and a lot of things. So no matter what we did, you know, no matter what we did, there would have been some kind of potential or perceived conflict. We did the best we could.

A lot of ethics watchdogs have pointed out that, or argued that, more should have been done, or more could have been done —

Charlie Kushner You want to know what I think about ethics watchdogs?

Laurent Morali [Laughing] No.

Charlie Kushner Do you really want to know what I think about those jerks?

Absolutely.

Charlie Kushner I think they’re a waste of time. They’re guys who can’t get a real job, ethics watchdog? Who gets a job – ethics watchdog? Give me a break.

But do you think though there is a legitimate concern about conflict of interest when a senior White House adviser still has stakes in all these properties?

And is meeting with, you know, all these heads of Citigroup and Apollo, and then loans are being transacted.

Charlie Kushner Okay, great example. He meets with the head of Citigroup, who I don’t know. So, [Michael Corbat], or whatever? I don’t know him. He meets with him a month or two ago. Did anybody ask how long I’m doing business with Citigroup? I’ve had a 35-year relationship with Citigroup. Did anybody ask if this guy, Corbat, however you spell his name, knew about our loan? I’m sure he didn’t. We have a 35-year relationship; we’ve borrowed hundreds and hundreds and hundreds, or maybe more than a billion dollars from them.

I’d think the ethics watchdogs would say that the strength and length of the relationship that you’re underlining is more of a reason for the divestment, more of a reason to reduce potential or perceived conflicts of interest.

Charlie Kushner All they want to do is assure that poor, not successful people go into government. That’s all they want to do. Because if you’re successful, you shouldn’t be penalized by stupid ethics watchdogs raising things that are potential. You know when there’s a conflict. It’s not a conflict when you meet with Jamie Dimon, and they’re giving a loan to a company that’s been in business for 40 years, 50 years, whatever it may be.

You see it as an attack on wealth? That sounds like the way you’re describing it.

Charlie Kushner They discourage rich, smart, successful people from going into government. Because a lot of rich, smart, successful people say, “Why the hell am I doing this?” I look at what my kids have sacrificed to go into government, with the only intent of doing good for this country and for the world, and to help people. And what they have sacrificed, and the daily barrage of negative media, and the attacks they get, and they had a perfect, beautiful life and they still have a very good life, but they sacrificed a lot.

Citigroup aside, do you think these concerns over conflicts of interests are legitimate?

Charlie Kushner No.

There’s no conflict of interest at all between a senior White House adviser holding a vast real estate portfolio?

Charlie Kushner Look, there’s a conflict of interest if he’s meeting with Jamie [Dimon], if he’s meeting with the head of one of these big institutions and all of a sudden they’re going to give me a $100 million line of credit. Yes, there’s a conflict. Are you kidding me? I have a 35-, 40-year relationship with a bank and I don’t even know who the [bank] president is? I mean I knew Sandy Weill, but I don’t know who the current president is. Where’s the conflict? I mean you could make it up. But in reality, there’s no conflict.

What about Apollo?

Charlie Kushner Apollo is the same thing. I don’t know the person that Jared met with. And Apollo, we’ve had a relationship with Apollo for 10 years. Well before Trump. So there is no conflict. They’re not giving us money because Jared is in the White House, and we’re not taking it. And by the way, all of these loans that we’re getting are very competitively priced.

Laurent Morali There are loans for which there were different offers, so we just decided to go with one lender and the decision that these guys made to deal with us.

Your name popped up very briefly in Michael Wolff’s book [“Fire and Fury”]…

Charlie Kushner Sure, it pops up in all nice places.

It was in there that you had personally lobbied to Jared and Ivanka to press for the firing of James Comey; the idea that you felt the investigations were getting to close to your business.

(Seryl Kushner laughs)

Charlie Kushner Do I look like a guy who doesn’t have enough problems that I have to go and get involved with James Comey? It’s just fucking nonsense. It’s totally false. Made up. Totally.

I lose sleep about a lot of things. I lose sleep that my children should be healthy, that my grandchildren should be healthy, that everybody should be well. I don’t lose one second of sleep about these stupid investigations because they are stupid investigations. They could waste as much time and taxpayer money as they want, but it’s all politically motivated. And we’re, thank God, big enough and strong enough to deal with it. We’ll give them the papers, so I do not lose one second of sleep. I don’t think about it one second of the day.

You guys think about it, but I don’t.

Let’s talk about your engagement with national politics recently. In the past, you were a big donor to Democratic politicians in New Jersey. And two years ago, you had a fundraiser for a PAC to support President Trump. Can you tell us about what’s changed, if anything, politically, for you? And why you now have put everything in with this administration?

Charlie Kushner The thing that I put into this administration is my son. That’s what, that’s my… I don’t share a lot of the Republican beliefs and values on a lot of issues. That being said, I don’t share a lot of the Democratic beliefs and values as I used to, much more firmly. The Democratic Party that I supported for all the years is not the same Democratic Party of today on a lot of issues that are very near and dear to my heart. I’m still a Democrat. But I shouldn’t say that. If I had to register today, I’d probably register myself as an independent, because I’m probably not in either political camp, truthfully, on a lot of the issues. It’s very controversial to say, I do believe in President Trump. I think he’s done a good job, I think he’s a great leader, and I think it’s very sad that our society…that it’s created — in a way, I think it’s almost healthy — but it’s sad that it’s created this terrible animosity and the inability to tolerate other people who don’t agree with your viewpoint. It’s just horrible, in my opinion.

What are some of the things that you think Jared is doing a good job of?

Charlie Kushner He just had passed prison reform. He understands it from a personal point of view because of my experience being incarcerated. I’m very proud that he is able to get a bipartisan issue, to accomplish something that will have a definite impact. It will have a positive impact on people and people’s lives. That one person that shouldn’t be in jail longer that could qualify under this new set of rules that can get out early and be with his family; or be able to get a job or they’re going to assist to give him a job, or assist to give him training, or assist to give him mental care, or drug rehabilitation care. That’s why he went to Washington. He didn’t go there for himself. He didn’t go there to have a better office or more money.

Do you see Jared coming back to Kushner Companies at some point? Is that going to happen?

Charlie Kushner I don’t know what Jared’s plans are. He has a very big agenda, I’m sure, in Washington. We have a big agenda here. I can tell you as a father, I speak to him every day and I’m proud of him every day, and I miss him every day. But what his plans are? He’s going to determine what his plans are.

Is there anything else you wanted to address that we didn’t?

Charlie Kushner You may want to ask me about Steve Roth [Vornado Realty Trust CEO].

Sure, tell us about Steve Roth.

Charlie Kushner You may want to ask me about that. Because I just want to say that people – it’s been falsely reported in the press that we’ve had fights, we’ve had this. We have nothing. I have nothing but the greatest respect and admiration for Steve Roth. I think he’s one of the smartest business leaders in our industry and I think that he’s a tough negotiator, but I never held tough against anybody. And behind that tough veneer is a very good, decent person. I hope you get that in.

I think that’s it.

Charlie Kushner We got off to a bad start, but I think we ended okay, right?

You didn’t kick us out, so I guess that’s good.

With assistance from Kathryn McCurdy.

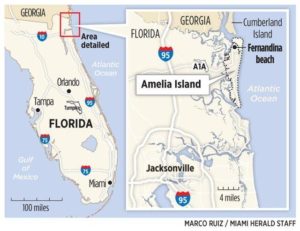

Situated in the uppermost part of eastern Florida, Amelia Island is a heavenly place to live, play and take in the wonders of the Atlantic Ocean and all its beauty. Fortis Investment Group has claimed a 50 acre parcel, a formerly unattainable piece, for development into 650 luxury condominiums, plus a series of beachfront homes on half acre lots, private gated resort community with spas, pools, shops and other niceties which have come to be expected on this beautiful island.

Situated in the uppermost part of eastern Florida, Amelia Island is a heavenly place to live, play and take in the wonders of the Atlantic Ocean and all its beauty. Fortis Investment Group has claimed a 50 acre parcel, a formerly unattainable piece, for development into 650 luxury condominiums, plus a series of beachfront homes on half acre lots, private gated resort community with spas, pools, shops and other niceties which have come to be expected on this beautiful island.

The sale came after local City Council member Brad Lander said that he basically wouldn’t approve a rezoning of the neighborhood if you guys, in any way, benefited from it. Was that sort of the death knell for the whole thing?

The sale came after local City Council member Brad Lander said that he basically wouldn’t approve a rezoning of the neighborhood if you guys, in any way, benefited from it. Was that sort of the death knell for the whole thing?

You met with Qatar’s minister of finance, Ali Sharif al-Emadi, after Trump took office. And you told the press that you were offered this meeting, but you took this meeting as a courtesy. During the meeting, you told the minister you would not accept sovereign wealth money. But why take the meeting in the first place if the point is just to tell him that you don’t want to take their money? Why not just send a polite letter or something?

You met with Qatar’s minister of finance, Ali Sharif al-Emadi, after Trump took office. And you told the press that you were offered this meeting, but you took this meeting as a courtesy. During the meeting, you told the minister you would not accept sovereign wealth money. But why take the meeting in the first place if the point is just to tell him that you don’t want to take their money? Why not just send a polite letter or something?